Should I Wait to Put Down a Bigger Down Payment?

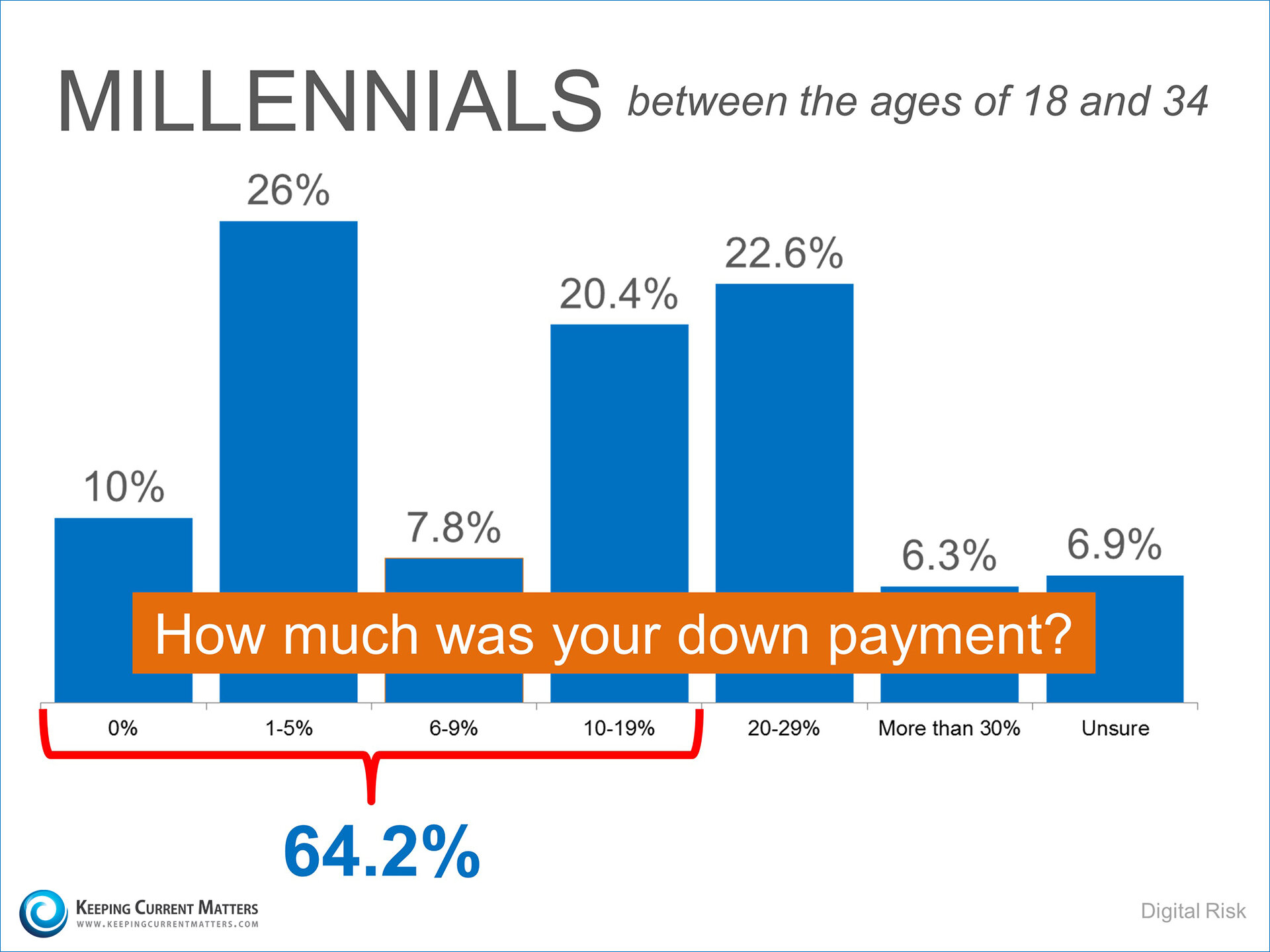

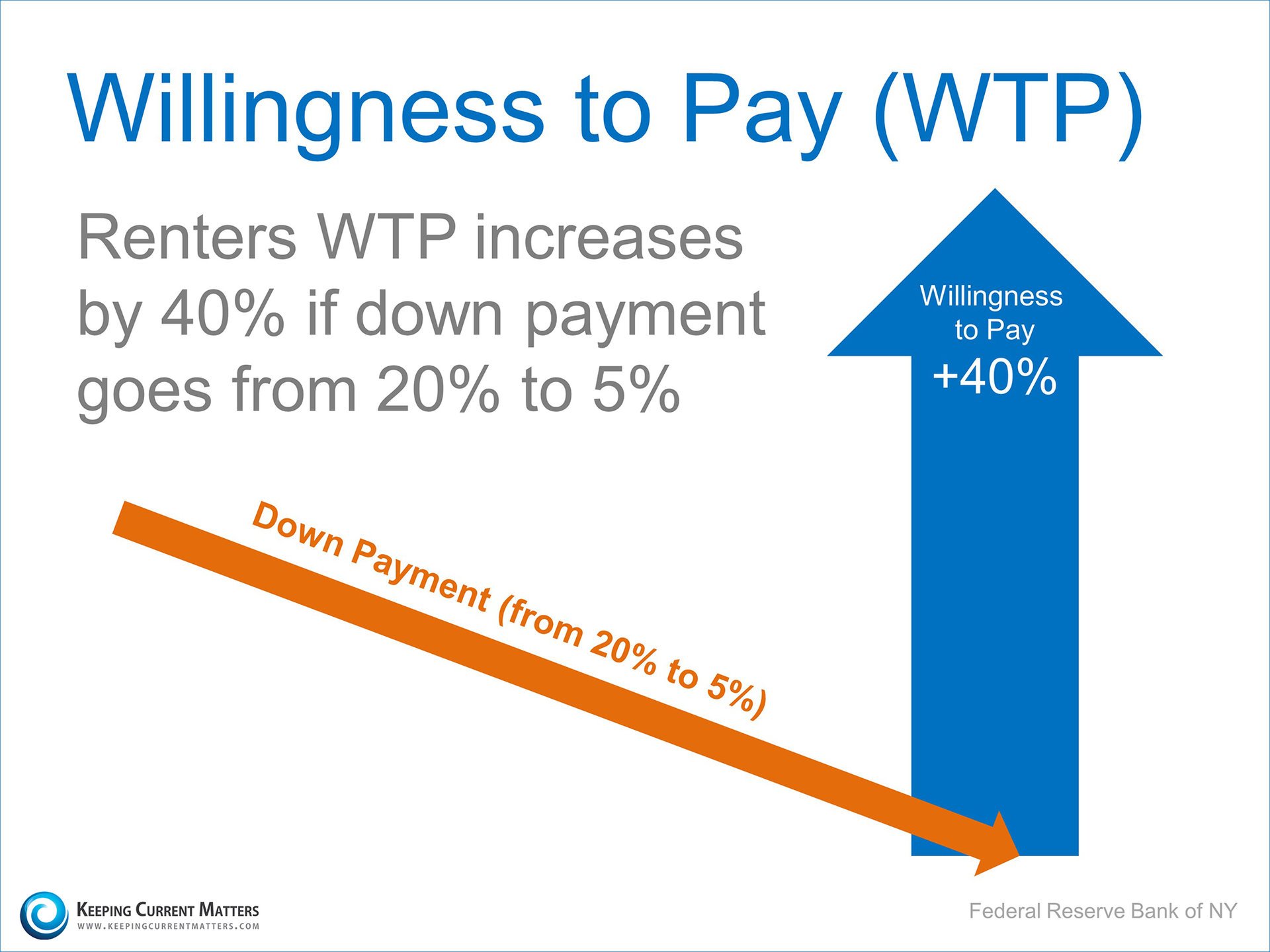

Some experts are advising that first time and move-up buyers wait until they save up 20% before they move forward with their decision to purchase a home. One of the main reasons they suggest waiting is that a buyer must purchase private mortgage insurance if they have less than the 20%. That increases the monthly payment the buyer will be responsible for.

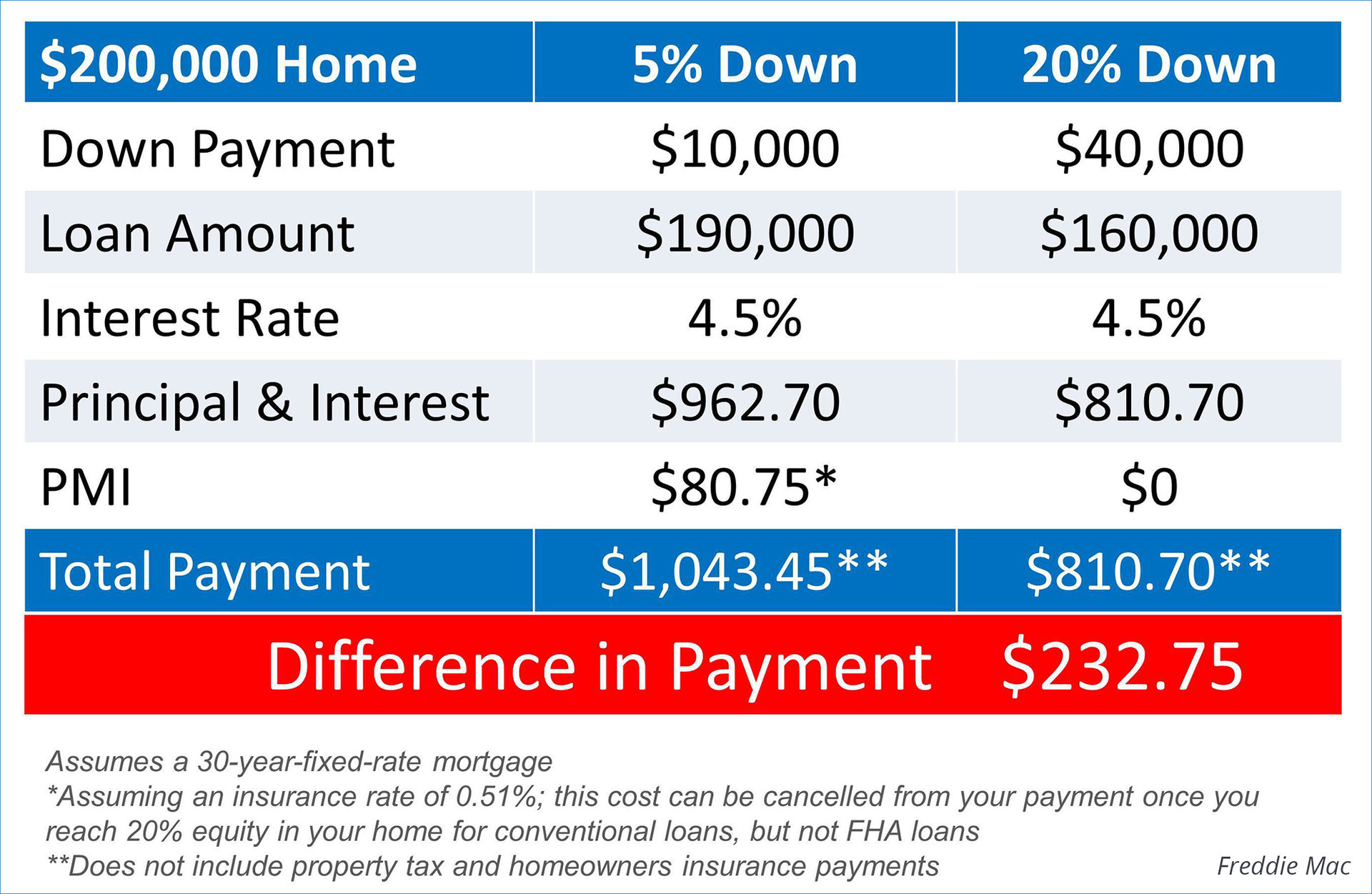

In a recent article, Freddie Mac explained what this would mean for a $200,000 house:

However, we must look at other aspects of the purchase to see if it truly makes sense to wait.

Are you actually saving money by waiting?

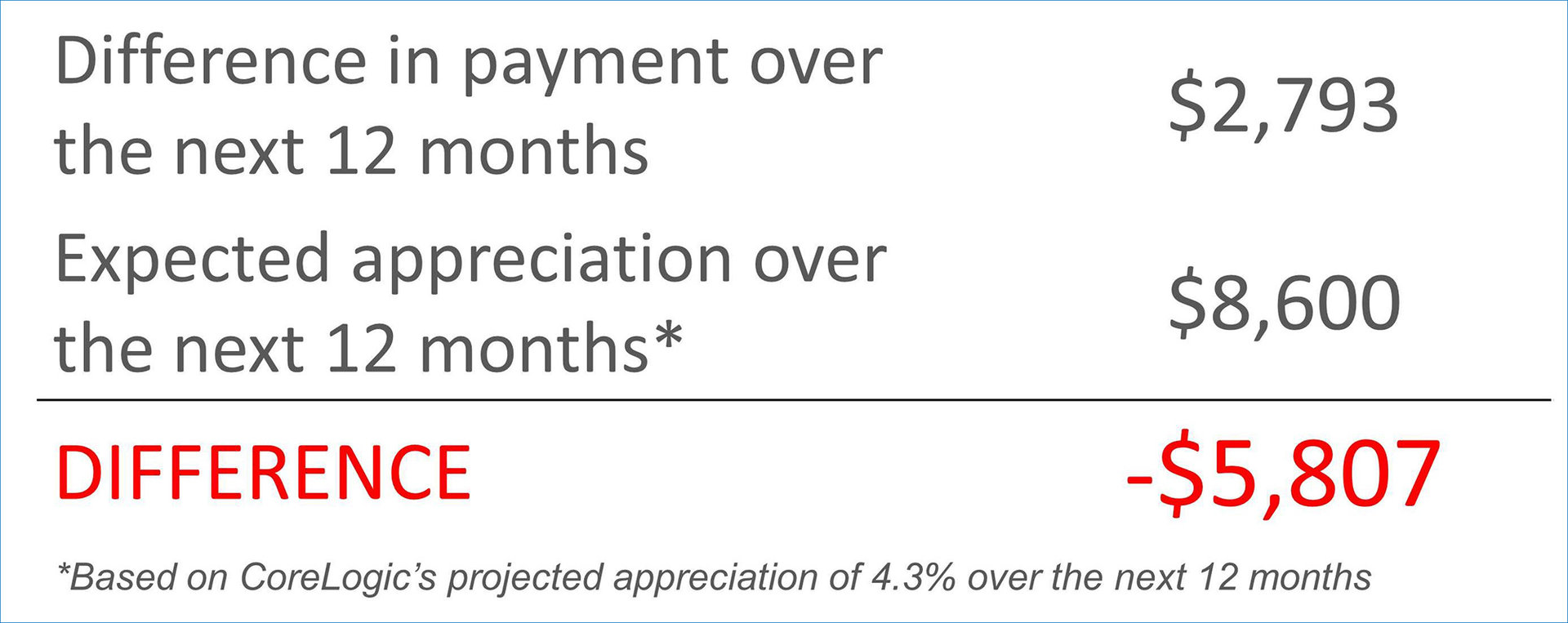

CoreLogic has recently projected that home values will increase by 4.3% over the next 12 months. Let’s compare the extra cost of PMI against the projected appreciation:

If you decide to wait until you have saved up a 20% down payment, the money you would have saved by avoiding the PMI payment could be surpassed by the additional price you eventually pay for the home. Prices are expected to increase by more than 3% each of the next five years.

Saving will also be more difficult if you are renting, as rents are also projected to increase over the next several years. Zillow Chief Economist Dr. Svenja Gudell explained in a recent report:

"Our research found that unaffordable rents are making it hard for people to save for a down payment ... There are good reasons to rent temporarily – when you move to a new city, for example – but from an affordability perspective, rents are crazy right now. If you can possibly come up with a down payment, then it's a good time to buy a home and start putting your money toward a mortgage."

Laura Kusisto of the Wall Street Journal recently agreed with Dr. Gudell:

“For some renters there may be a way out: Buy a house. Mortgages remain very affordable.”

Mortgage rates are expected to rise…

Freddie Mac is projecting that mortgage interest rates will increase by almost a full percentage point over the next 12 months. That will also impact your mortgage payment if you wait.

Bottom Line

Sit with a real estate or mortgage professional to truly understand whether you should buy now or wait until you save the 20%.